South Dakota Excise Tax Exemption Form . Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. Fixture to real property must have a south dakota contractor's excise tax license. This includes repair or remodeling of existing real property or. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. It lists the types of exemptions and the conditions for each exemption,. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. Not all states allow all exemptions listed on this form. South dakota department of revenue. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat.

from www.formsbank.com

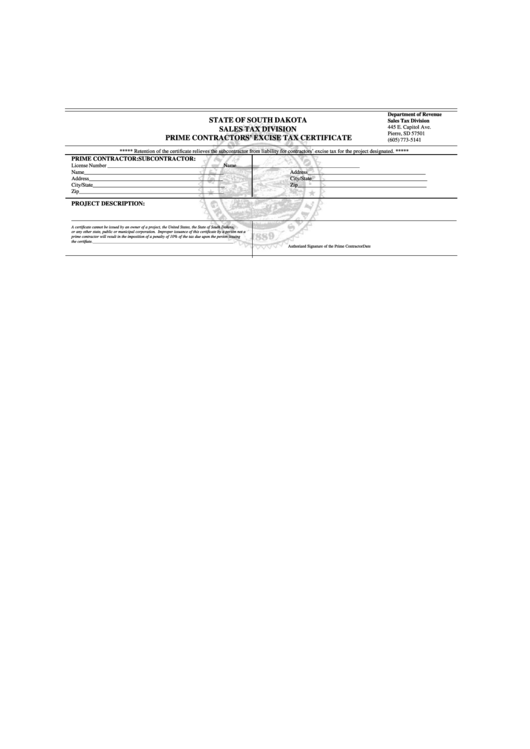

Fixture to real property must have a south dakota contractor's excise tax license. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. Not all states allow all exemptions listed on this form. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. This includes repair or remodeling of existing real property or. It lists the types of exemptions and the conditions for each exemption,. South dakota department of revenue.

Top 14 South Dakota Sales Tax Form Templates free to download in PDF

South Dakota Excise Tax Exemption Form Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. Fixture to real property must have a south dakota contractor's excise tax license. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. Not all states allow all exemptions listed on this form. South dakota department of revenue. This includes repair or remodeling of existing real property or. It lists the types of exemptions and the conditions for each exemption,. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota.

From www.pdffiller.com

Nc Certification 501 3 Form Fill Online, Printable, Fillable, Blank South Dakota Excise Tax Exemption Form South dakota department of revenue. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. It lists the types of exemptions and the conditions for each exemption,. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. Not all states allow all exemptions. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Form Qctws Contractor'S Excise Tax Return Worksheet/instructions South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. This includes repair or remodeling of existing real property or. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. South dakota department. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Certificate Of Exemption South Dakota Streamlined Sales Tax Agreement South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. Fixture to real property must have a south dakota contractor's excise tax license. South dakota department of revenue. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. The secretary of revenue may, at his discretion, refuse to. South Dakota Excise Tax Exemption Form.

From www.tptools.com

State Tax Exemption Forms TP Tools & Equipment South Dakota Excise Tax Exemption Form The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. Not all states allow all exemptions listed on this form. South dakota department of revenue. This includes repair or remodeling of existing real property or. This form is used to claim an exemption from the south dakota. South Dakota Excise Tax Exemption Form.

From www.exemptform.com

South Dakota State Tax Exempt Form South Dakota Excise Tax Exemption Form South dakota department of revenue. This includes repair or remodeling of existing real property or. Not all states allow all exemptions listed on this form. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. This form is used to claim an exemption from the south dakota. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Top 14 South Dakota Sales Tax Form Templates free to download in PDF South Dakota Excise Tax Exemption Form This includes repair or remodeling of existing real property or. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. It. South Dakota Excise Tax Exemption Form.

From www.exemptform.com

How To Fill Out Tax Exempt Form South Dakota Excise Tax Exemption Form This includes repair or remodeling of existing real property or. It lists the types of exemptions and the conditions for each exemption,. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. South dakota department of revenue. This form is used to claim an exemption from the south dakota excise tax on a south dakota. South Dakota Excise Tax Exemption Form.

From www.taxuni.com

South Dakota Excise Tax Exemption Certificate South Dakota Excise Tax Exemption Form The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. Fixture to real property must have a south dakota contractor's excise tax license. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales. South Dakota Excise Tax Exemption Form.

From www.exemptform.com

FREE 8 Sample Tax Exemption Forms In PDF MS Word South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. Fixture to real property must have a south dakota contractor's excise tax license. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota.. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Fillable Sales And Contractors' Excise Tax License Application Form South Dakota Excise Tax Exemption Form Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. This includes repair or remodeling of existing real property or. It lists the types of exemptions and the conditions for each exemption,. This form is used to claim an exemption from the south. South Dakota Excise Tax Exemption Form.

From www.templateroller.com

SD Form 1739 (MV609) Fill Out, Sign Online and Download Fillable PDF South Dakota Excise Tax Exemption Form The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. This includes repair or remodeling of existing real property or. Not all states allow all exemptions listed on this form. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. This form. South Dakota Excise Tax Exemption Form.

From tutore.org

Federal Tax Exempt Certificate Master of Documents South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. This includes repair or remodeling of existing real property or. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. Suppliers who are. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Fillable Sd Eform 1341v2 South Dakota Farm Winery Excise Tax Report South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of materials and. South dakota department of revenue. Fixture to real property must have a south dakota contractor's excise tax license. Laws, regulations and frequently asked. South Dakota Excise Tax Exemption Form.

From forms.utpaqp.edu.pe

Types Of Sales Tax Exemption Certificates Form example download South Dakota Excise Tax Exemption Form Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. Fixture to real property must have a south dakota contractor's excise tax license. It lists the types of exemptions and the conditions for each exemption,. Not all states allow all exemptions listed on this form. Suppliers who are licensed under the south dakota sales and. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Top 22 South Dakota Tax Exempt Form Templates free to download in PDF South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. Fixture to real property must have a south dakota contractor's excise tax license.. South Dakota Excise Tax Exemption Form.

From www.formsbank.com

Top 22 South Dakota Tax Exempt Form Templates free to download in PDF South Dakota Excise Tax Exemption Form Laws, regulations and frequently asked questions regarding contractor’s excise tax on businesses in south dakota. The secretary of revenue may, at his discretion, refuse to issue a license to any person who is delinquent in payment of contractor's. South dakota department of revenue. Fixture to real property must have a south dakota contractor's excise tax license. It lists the types. South Dakota Excise Tax Exemption Form.

From www.uslegalforms.com

Sd Tax Exempt Form Fill and Sign Printable Template Online US Legal South Dakota Excise Tax Exemption Form It lists the types of exemptions and the conditions for each exemption,. This form is used to claim an exemption from the south dakota excise tax on a south dakota titled vehicle or boat. South dakota department of revenue. This includes repair or remodeling of existing real property or. The secretary of revenue may, at his discretion, refuse to issue. South Dakota Excise Tax Exemption Form.

From daryllauer.blogspot.com

south dakota excise tax on vehicles Daryl Lauer South Dakota Excise Tax Exemption Form Not all states allow all exemptions listed on this form. It lists the types of exemptions and the conditions for each exemption,. Fixture to real property must have a south dakota contractor's excise tax license. Suppliers who are licensed under the south dakota sales and use tax law must remit sales or use tax to the state on sales of. South Dakota Excise Tax Exemption Form.